Nps tax benefits 2020 – sec.80ccd(1), 80ccd(2) and 80ccd(1b) 80d deduction preventive Heads of tax

Section 80d Preventive Health Check Up Tax Deduction - The gray tower

Free income tax photos and images Income tax: minor’s income is clubbed with that of parent with higher Heads of income under the income tax act, 1961

Understanding form 26as

Challan tax jagoinvestor paying interest recieptExample of taxable supplies A quick guide to section 194l & 194la of the income tax act underHow to pay income tax online : credit card payment is recommended to.

List of major and minor headsFillable online do higher state income tax fax email print How to pay income tax online i e-payment of income tax i minor headChallan correction tds fields.

Tds tax india: income tax :- minor correction in excel based individual

Minor income tax return india clubbing sharesWhat is income tax form 16? automatic income tax form 16 Minor income tax return in india + what is clubbing of income of minor?Solved a group of 50,000 tax forms has an average gross.

Fillable form 1120 hWho should sign a minor's federal income tax return? What are the tax benefits that nps offers?How to claim section 80ccd(1b)?.

Tax 1040 form income quoteinspector signature return start 1920 1280 optimized web

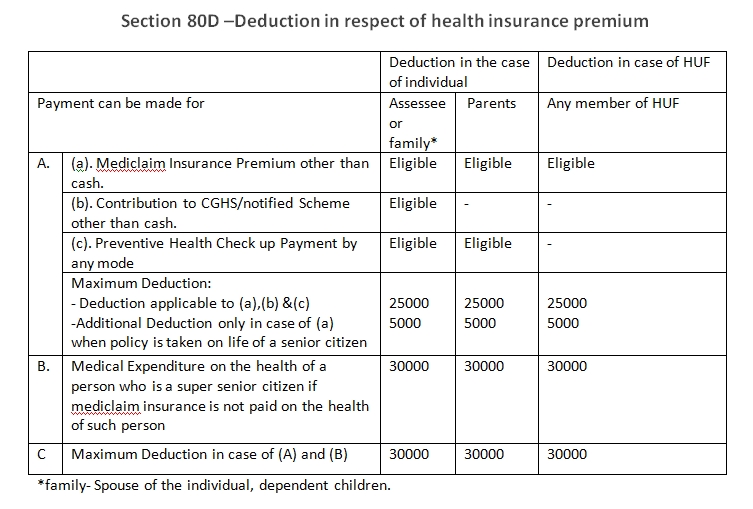

Section 80ccd 1b deductionApplicability of tds on purchase of goods (section 194q) Preventive check up 80d – wkcnSection 80d preventive health check up tax deduction.

Tds challan paying salary computationIncome tax act 80d Filing income tax returns for minorsRelief under section 89(1) for arrears of salary.

Tax on shares buyback?

Oltas challan correctionIncome tax estimates Section 80ccc of income tax act: 80ccc deduction, tax benefits andProfzilla.com articles.

Income minors filingHow do minors file income taxes? Section 80ccd: deduction under 80ccd (1), 80ccd (1b), 80ccd (2)Procedure after paying challan in tds.

Solved A group of 50,000 tax forms has an average gross | Chegg.com

How to claim Section 80CCD(1B)? - TaxHelpdesk

Income Tax Estimates

Who Should Sign a Minor's Federal Income Tax Return? | Budgeting Money

Tds Tax India: Income Tax :- Minor correction in Excel Based Individual

What is Income Tax Form 16? Automatic Income Tax Form 16

List of Major and Minor Heads | PDF | Saving | Taxes

Section 80d Preventive Health Check Up Tax Deduction - The gray tower